Taking larger draws can be risky because if the owner’s draw is too large, the business may not have enough funds to move forward. Taking large drawsĭetermine the maximum amount you can take in owner’s draws and stick to it.

Business owners who take draws must typically pay estimated taxes and self-employment taxes, and some may choose to pay themselves a salary instead.Īn owner’s draw determines how much you pay yourself the amount may fluctuate depending on your business you should also consider operating costs and other expenses before deciding how much to pay yourself with an owner’s draw.

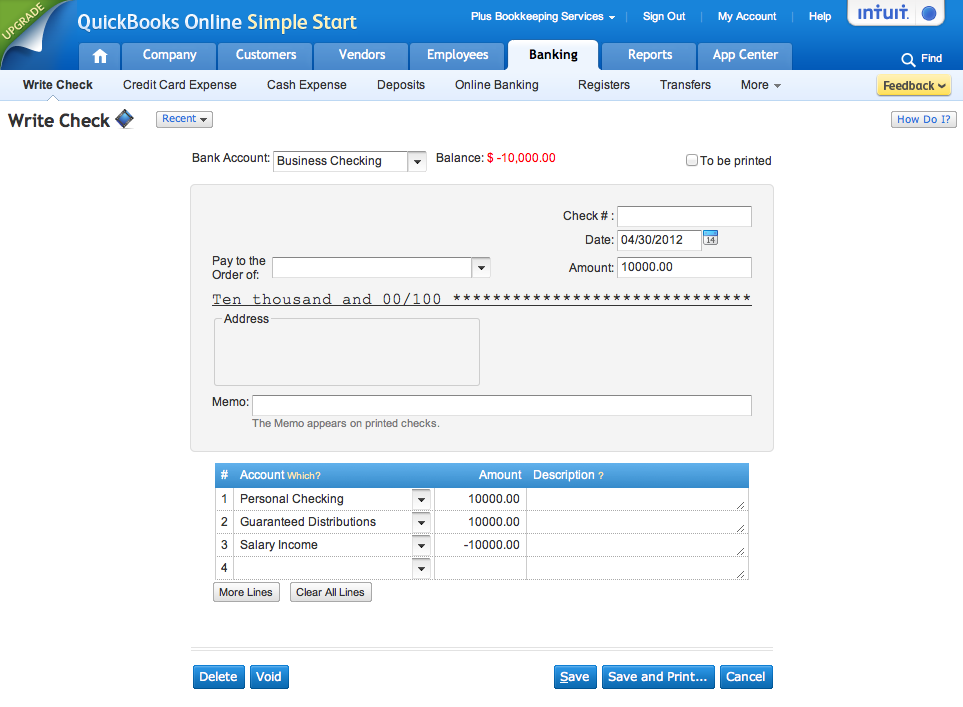

Are owner’s draws taxable?Ī business owner’s draw is not taxable on the company’s income, but it is taxable as income on the owner’s personal tax return. Corporations, such as an S Corp, typically cannot take owner’s withdrawals. In most cases, you must be a sole proprietor, an LLC member, or a partner in a partnership to take owner’s withdrawals. Owner’s equity is made up of a variety of funds, including money you’ve invested in your company. What is an owner’s draw?Īn owner’s draw occurs when a business owner withdraws funds from their company for personal use rather than paying themselves a salary. If you need assistance with this process, visit with one of our QuickBooks Experts at (888) 388-1040.You probably pay wages to your employees as a business owner, but how do you pay yourself? Depending on your business structure, you may be able to pay yourself an owner’s draw.

The PPP Loan Funds sub-account will show how much of the funds remain.Īfter your lender determines how much of the loan is forgiven, you can transfer the forgiven amount. These amounts can be obtained from a Payroll Summary by Employee report. The transfer amount used for payroll will be for the allowable expenses only (gross wages, employer retirement plan contribution, employer health insurance premiums paid). Note in the memo what the transfer is for.

RECORDING PERSONAL EXPENSES IN QUICKBOOKS HOW TO

There are a few options in QuickBooks Online for how to record the funds received from the Paycheck Protection Program (PPP) loan and the expenses to which the funds are used. Recording a PPP Loan and Tracking Corresponding Expenses

0 kommentar(er)

0 kommentar(er)